Times New Roman

16

Introducing IntentX ICO

Publish: (UTC) 07:05 AM - 23 May 2024

●Author: Moby Team

We are thrilled to announce the next Early Access round with IntentX, the next-generation OTC derivatives exchange offering perpetual futures trading.

IntentX stands at the forefront of on-chain finance with a unique combination of cross-chain communication, account abstraction, and SYMMIO, a zero-to-one breakthrough settlement layer that addresses critical challenges in delivering on-chain derivatives. These innovations enable IntentX to offer Omnichain deployment, lower fees, greater liquidity, enhanced capital efficiency, and improved scalability compared to current solutions.

Key Highlights

- Backed by Mantle EcoFund, Selini Capital, Mirana Ventures and other top-tier investors.

- Open-beta trading launch for 6 months with 261 tradable pairs offering deep liquidity, accumulating 15K+ users, and $2.8 billion in total trade volume.

IntentX users will enjoy the best price execution with minimal slippage, efficient price discovery, and CEX-like liquidity and execution, but with DEX-level security. The platform is approximately 100 times more capital-efficient than existing vAMM derivatives exchanges, based on Open Interest to Total Value Locked (OI/TVL) ratio.

Learn more about IntentX: here

INTENTX ICO:

Start date: May 23, 12 pm UTC

End date: May 28, 12 pm UTC

The ICO will be on Mantle Network. You will need to have $USDC on Mantle to participate in the IntentX ICO.

The ICO claim will be in form of staked xINTX to align long-term stakeholders with the protocol. xINTX represents the staked form of $INTX and is the key value driver to IntentX stakeholders with benefits including, receiving 85% of the platform revenues, rewarding long-term stakers, safeguarding stakeholders from short-term trading habit and participating in governance votings.

Before participating in the ICO, it is recommended to read this article to have a comprehensive understanding of IntentX tokenomics.

Frequently Asked Questions:

Can xINTX be converted into $INTX? Yes, immediately at TGE. There is a 'Loyalty staking duration' of 16 weeks where revenue boosts are increased linearly over the maturity of your staked position, up to 2.5x. On the other hand, if you decide to convert early (prior to the 16 weeks), there is a 'exit penalty' that start as high as 25% and decay overtime to 1% after the 16 weeks period.

Why is it claimed in xINTX? All stakeholders are aligned on the long-term vision of IntentX by committing with the vesting strategy, including Seed, Strategic participants, Team and Advisors,.. To Moby, the IntentX vesting is innovative and carefully designed with the ‘boost’ and ‘exit penalty’ systems. The ratio of xINTX to $INTX is 1:1, which increases over time thanks to the staking penalty (1 - 25%), means that if any stakers chose to exit before maturity, the penalty fee will go back to the loyal stakers.

WHITELIST ROUND MECHANISM

Target raise of 1,250,000 $USDC at fixed valuation of $50M FDV for IntentX community ONLY . The vesting is 100% at TGE , claimable in the form of staked xINTX to participate and align with the long-term IntentX stakers.

Whitelists are distributed among IntentX’s traders and community members. Eligible participants can contribute for $INTX at launchmoby.com , capped at their equivalent Whitelist allocations.

Start date: May 23, 12 pm UTC

End date: May 25, 12 pm UTC

EARLY ACCESS MECHANISM

Target Raise of 1,500,000 $USDC at fixed valuation of $50M FDV , available for Moby stakers only. The vesting is 100% at TGE , claimable in the form of staked xINTX to participate and align with the long-term IntentX stakers.

Eligibility: Staking $MOBY before May 17, 2 pm UTC.

Snapshot data:

- Total Moby Chips: 142,092,907 CHIPS

- Total $MOBY stakers: 1,896 stakers

Note: Introduced in Moby Staking V2.0, Moby Chips is the new official measure, used to calculate the allocation of each individual stakers. This initiative allows us to strengthen the benefits of long-term stakers. Learn more about Moby Staking V2.0: here

Mechanism: Overflow

- Eligible $MOBY stakers contribute $USDC for $INTX allocation in the Early Access round:

- Your max contribution amount (in USDC) = 0.052 * Your total Moby Chips at the snapshot period.

- Your max contribution amount ≠ your final allocation if the sale reaches the ‘Overflow' stage (meaning the total contribution amount surpasses the ‘Target Raise' ). The more you contribute, the more allocations you receive.

- The final allocation will be based on the amount of funds each staker put in as a percentage of all funds put in by other stakers at the end of the Early Access round.

- Users will reclaim any leftover funds after the contribution period ends.

Note: If you commit a very small amount of $USDC compared to the total amount committed by others, your contribution may be such a small part of the total that you may not qualify for even a small portion of the tokens sold. In such a case, you can still reclaim all committed funds.

Timeline:

- Contribution period: May 23-25, 12 pm UTC

- Rebalancing allocation and refund: May 25, 12 pm UTC

PUBLIC ICO MECHANISM

Target Raise of 1,750,000 $USDC at fixed valuation of $70M FDV with a max cap of 10,000 $USDC per wallet, available for everyone. The vesting is 100% at TGE , claimable in the form of staked xINTX to participate and align with the long-term IntentX stakers.

Moby stakers will have 10 minutes head start into the Public ICO.

Non-stakers will be charged 15% fee.

Timeline:

- Contribution period: May 26-28, 12 pm UTC.

$INTX TOKEN

Token name: INTX

Network: Mantle

Symbol: INTX

Total Supply: 100,000,000

Initial Market Cap (Excluding Liquidity): $6,550,000

The IntentX tokenomics are built and centered around xINTX, which is the staked form of INTX and serves as the project's main utility and value capture mechanism. The platform offers up to 85% revenue share (derived from the IntentX DEX and its serviced front-ends) for $INTX stakers .

Release Schedule*

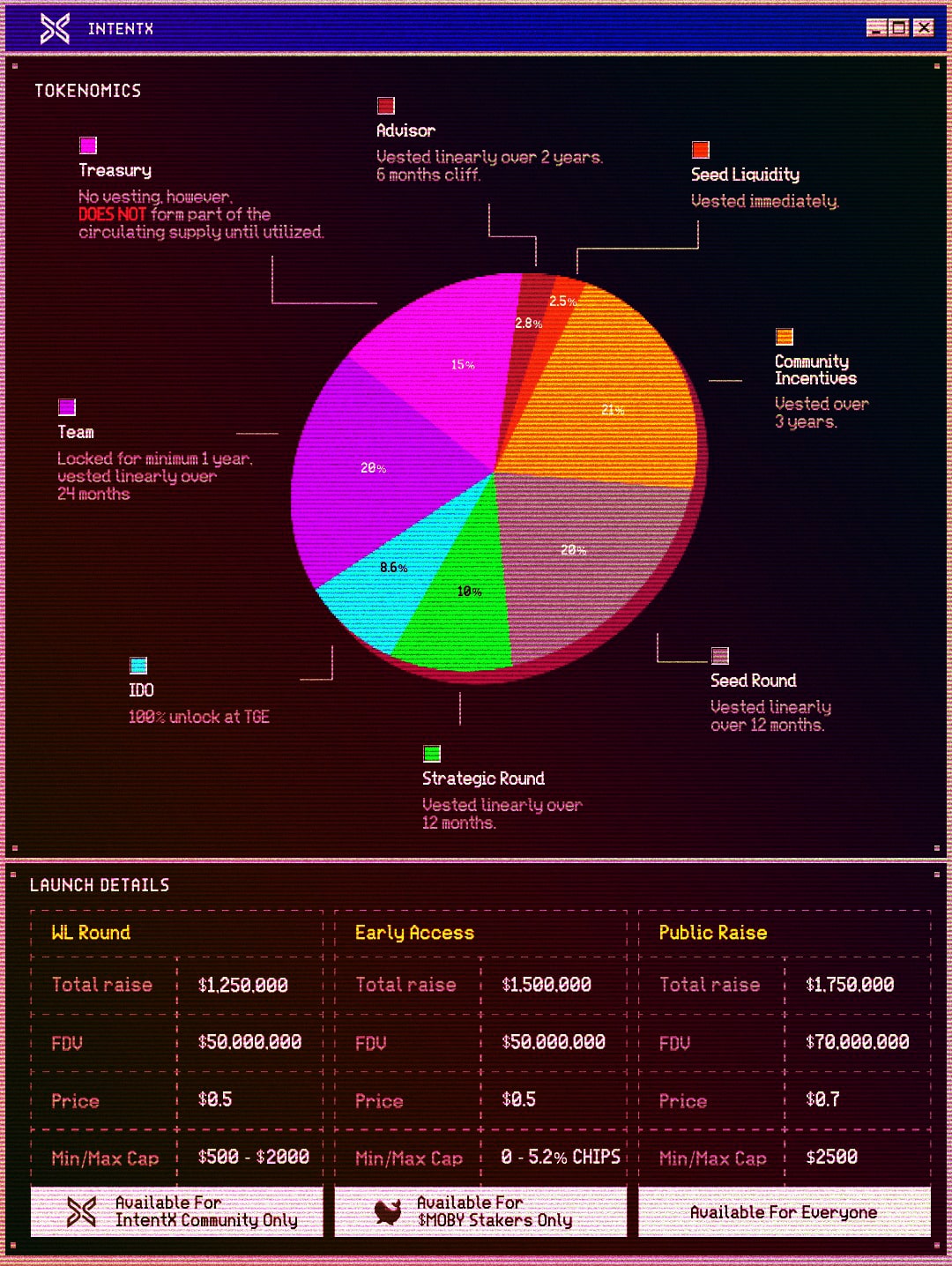

Percentage | Category | Vesting |

21% | Community Incentives | Vested over 3 years. |

20% | Seed Round | Vested linearly over 12 months. |

10% | Strategic Round | Vested linearly over 12 months. |

8.6% | IDO | 100% unlocked at TGE. |

20% | Team | Locked for minimum 1 year, vested linearly over 24 months. |

15% | Treasury | No vesting, however, DOES NOT form part of the circulating supply until utilized. |

2.8% | Advisor | Vested linearly over 2 years. 6 months cliff. |

2.5% | Seed Liquidity | Vested immediately. |

Exclusively launching on Moby!

IntentX Relevant Links:

Website: https://intentx.io/

Twitter: https://twitter.com/IntentX_

Discord: https://discord.gg/IntentX

Tokenomics: https://medium.com/@IntentX/crafted-with-intent-a-deep-dive-into-intentxs-tokenomics-4ede0e48a582

SEE YOU AT THE EARLY ACCESS!

Whitepaper: https://docs.launchmoby.com/

Website: https://launchmoby.com/

Discord: https://discord.gg/mobyhq

Telegram: https://t.me/MobyHQ